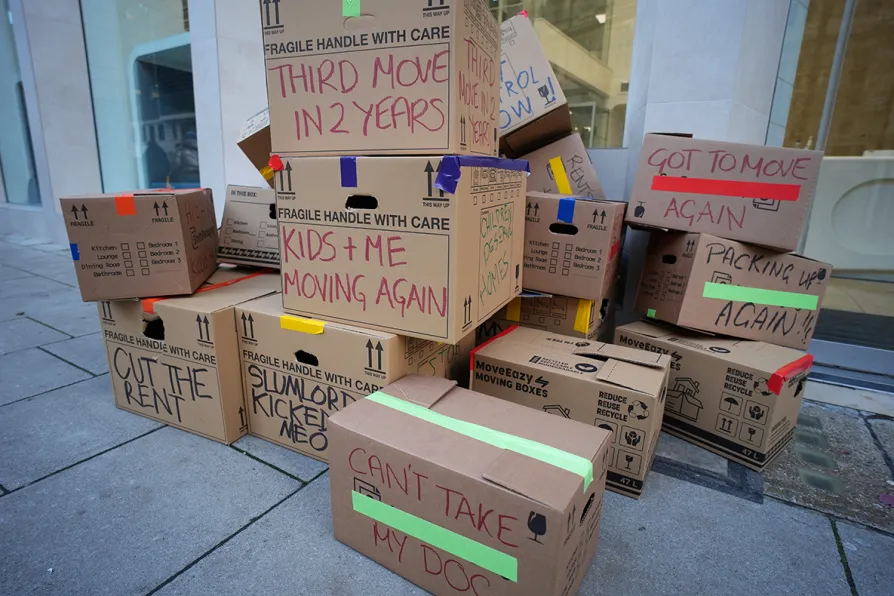

Empty cardboard boxes outside Foxtons in London, following a protest against soaring rents, December 14, 2024

Empty cardboard boxes outside Foxtons in London, following a protest against soaring rents, December 14, 2024

SINGLE Londoners would need to wait 56 years to afford a home, according to new analysis released today.

The research, by campaign group Generation Rent, found that being single adds 49 years to the time needed to save a deposit on a home in the capital.

The group calculated that a couple earning the average salary in London and saving 20 per cent of their income after tax and rent would have enough for a deposit of £66,401, the average for a first-time buyer home, after 6.6 years.

But for singletons, the wait stretches by decades, as they can only borrow half the mortgage a couple could, meaning they’d need to save £275,000 for a £484,000 home.

Nationally, the average time for a single person to save the deposit is 21 years, compared with 2.6 years for a couple, the research found.

Dan Wilson Craw, deputy chief executive of Generation Rent, said: “Homes are the foundations of our lives, but decades of rising house prices have left home ownership off-limits to single people in most of the country — and impossible in London if you don’t have family wealth.

“Building more homes will slow the rise of rents and prices, reducing the time needed to save.

“But to really make a difference, the government should look again at the advantages investors have, such as interest-only mortgages, that have allowed them to outbid first time buyers.

“Giving metro mayors the power to limit rent increases in cities like London would also help give renters some breathing space to start saving.”

An MHCLG spokesperson said: “We inherited the worst housing crisis in living memory, leaving a generation locked out of homeownership.

“We’re changing this by building 1.5 million homes and launching a new, permanent Mortgage Guarantee Scheme to show our commitment to restoring the dream of homeownership for more hard-working single renters.”