ANDY HEDGECOCK relishes two exhibitions that blur the boundaries between art and community engagement

How the wealth of the few is maintained

WILL PODMORE is intrigued by an analysis of capital that emphasises the deadening impact of financialisation on the US and UK economies

Endgame: economic nationalism and global decline

Jamie Merchant, Reaktion, £15.95

JAMIE MERCHANT is media director for the Center for Progressive Strategy. He depicts the decline of capitalism, focusing on the US and British economies.

US real growth per head averaged 2.3 per cent from 1953 to 1973, 2 per cent from 1973 to 2007, and 0.7 per cent from 2007 to 2019. From 1950 to 1973, the world economy grew on average by 2.92 per cent per head, by 1.8 per cent from 1973 to 1990, then by 1.5 per cent, down to 1.2 per cent in 2019.

More from this author

The phrase “cruel to be kind” comes from Hamlet, but Shakespeare’s Prince didn’t go in for kidnap, explosive punches, and cigarette deprivation. Tam is different.

ANGUS REID deconstructs a popular contemporary novel aimed at a ‘queer’ young adult readership

A landmark work of gay ethnography, an avant-garde fusion of folk and modernity, and a chance comment in a great interview

ANGUS REID applauds the inventive stagecraft with which the Lyceum serve up Stevenson’s classic, but misses the deeper themes

Similar stories

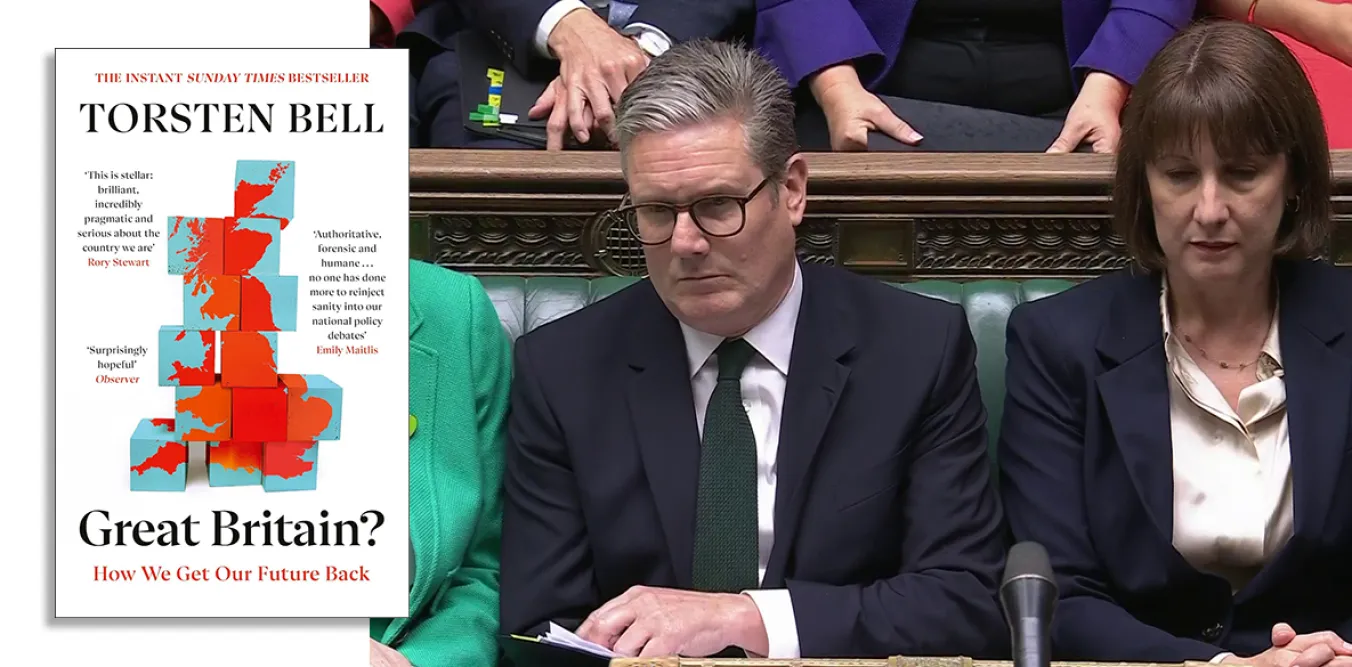

Where is the political programme for a plausible project of renewing Britain through public investment, asks WILL PODMORE

Despite pledges from the late president that absolute poverty would be eradicated by 2022, the reality is that Iran’s commitment to neoliberalism has seen working people plunged ever-deeper into misery, says JAMSHID AHMADI

The Star publishes the Karl Marx Graveside Oration delivered by Lord JOHN HENDY KC at Highgate Cemetery on Sunday, on behalf of the Marx Memorial Library