New releases from Bill Callahan, The Delines, and Beck

MARTIN GRAHAM welcomes a comprehensive history of the national debt, while regretting that it is neither up to date, nor has a class-based analysis

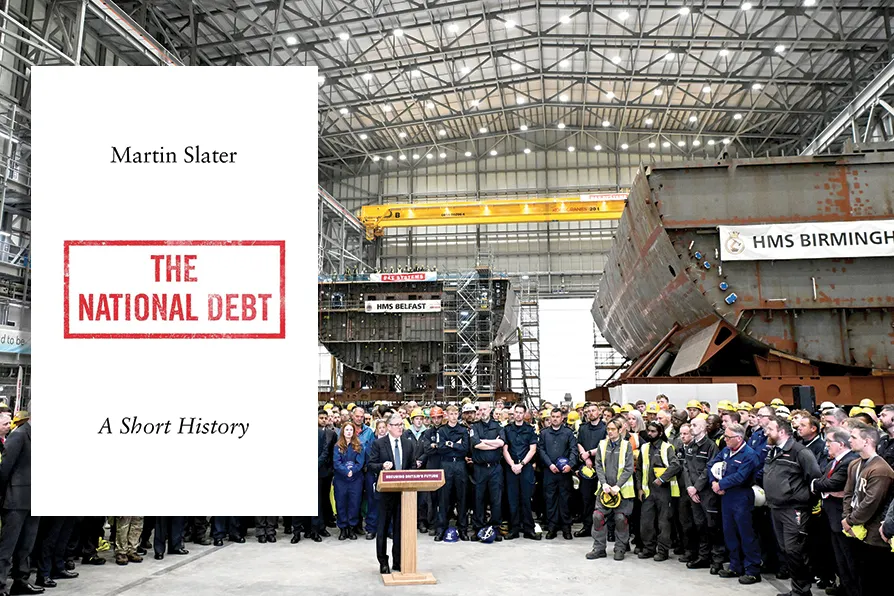

FUELING NATIONAL DEBT: Sir Keir Starmer speaks during a visit to BAE Systems in Govan, Glasgow, to launch the Strategic Defence Review on June 2 2025

FUELING NATIONAL DEBT: Sir Keir Starmer speaks during a visit to BAE Systems in Govan, Glasgow, to launch the Strategic Defence Review on June 2 2025

The National Debt: A Short History

Martin Slater, Hurst, £14.99

AS the title implies, most of this book comprises a comprehensive and detailed history of the national debt, that is: the indebtedness of the government to its creditors, both citizens and foreigners. Martin Slater is an emeritus fellow in economics at St Edmund Hall, University of Oxford, and well equipped to write such a history which stretches from the first borrowing by medieval English kings to enable them to wage wars, through to the creation of the Bank of England in 1694, and up to the present day.

The book was first published as a hardback in 2018 when it included data up to 2017. These data have not been substantially updated for this paperback edition, but it has an additional chapter which comments on developments to November 2024.

The history recounted by Martin Slater demonstrates that the national debt invariably increases when war and the threat of war require immediate government expenditure. At such a moment there is no time to raise money with taxes, while those in a position to restrain monarchs and governments seek to stop them creating money by fiat.

Conversely, subsequent repayment requires budget surpluses, and these must be hard won and are only achievable in times of peace. Budget surpluses require a government to cut expenditure, increase taxation or both, and, if and when they are achieved, history demonstrates that there are often other more attractive ways for governments to spend the money.

As a result, governments tend to become reconciled to a perpetual national debt and their concern shifts from a desire to be free of debt to concern that the current level of tax receipts and expenditure may not be sufficient to pay the interest on current and projected further borrowing.

The crucial criteria then become the taxpayers’ willingness to pay these taxes, the effect these taxes may have on the growth of the economy, on class and other distributional implications, and the willingness of lenders to lend and the rate of interest they demand. An important measure in such assessments is the ratio of national debt to gross domestic product (GDP).

Slater’s historical narrative is detailed and informative, but it lacks any substantial class analysis. He acknowledges the inherent instability of the banking system but doesn’t reflect on the instability of capitalism itself. There is no discussion, for example, of what steps a government wishing to implement socialist policies might take to counter resistance by capital acting through so-called “bond market vigilantes.”

In the additional chapter, the author acknowledges that the sustainability of the national debt has significantly deteriorated since 2018. With Brexit, Covid and the Truss debacle all affecting levels of borrowing, this is hardly surprising. A more extensive update, supported by revised data, would have been very welcome and the need for it remains.

In addition to the historical narrative and the current concerns expressed in the additional chapter, there are informative discussions on such matters as: what ratio of national debt to GDP is sustainable; what government borrowing escapes the national debt or may be wrongly included; and whether so-called whole of government accounts (which reflect a government’s assets and liabilities as well as its cash flow) would be helpful in assessing national debt sustainability.

For anyone interested in government finance and the wider context of money, banking and credit, this book is invaluable — even if their interests are prompted by a Marxist perspective that the author doesn’t share. Every reader will however, be disappointed that this edition does not include revised and updated data.