JOHN GREEN, MARIA DUARTE and ANGUS REID review Fukushima: A Nuclear Nightmare, Man on the Run, If I Had Legs I’d Kick You, and Cold Storage

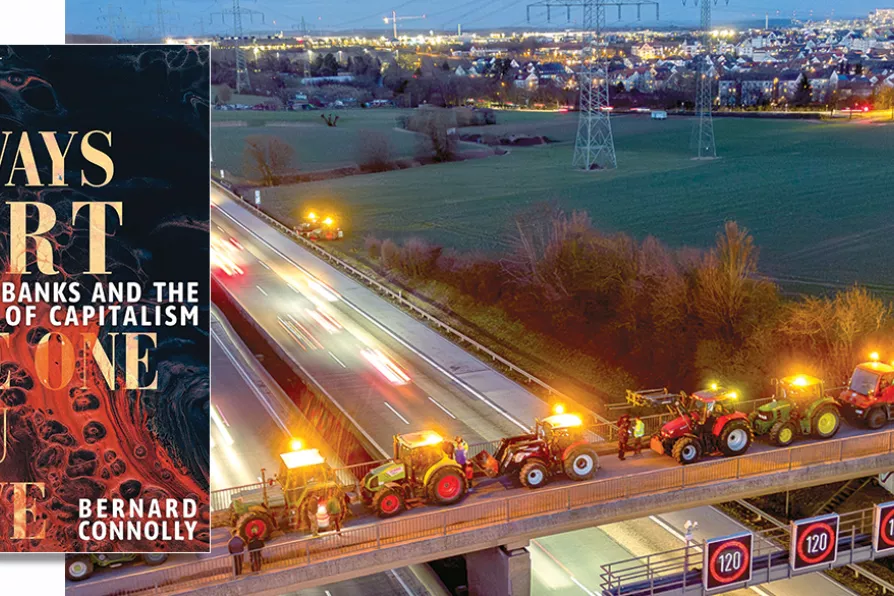

BRIDGE OVER TROUBLED WATERS: Farmers have parked their tractors on a small bridge over a highway in Frankfurt, Germany on January 26 2024

BRIDGE OVER TROUBLED WATERS: Farmers have parked their tractors on a small bridge over a highway in Frankfurt, Germany on January 26 2024

You always hurt the one you love: central banks and the murder of capitalism

Bernard Connolly

Unicorn, £30

BERNARD CONNOLLY is the excellent economist who wrote the brilliant critique of the euro, The Rotten Heart Of Europe. In this fine book, he analyses what he calls “the global Ponzi scheme” that is present-day capitalism.

He acknowledges that “there has been extractive behaviour (what Marxists would call exploitation) on a massive scale... What has happened in Western economies in this century in terms of financial crises and massive inequalities of income and particularly, wealth, can appear to validate Marxist predictions.”

As he notes, Marx believed that crisis was inherent in the nature of capitalism and wanted the crisis to be resolved by instituting a socialist system. Friedrich von Hayek, by contrast, believed that recurrent crises in capitalism were caused not by the nature of private property but by monetary mismanagement, and wanted crises to be resolved in a way that preserved capitalism.

From summit to summit, imperialist companies and governments cut, delay or water down their commitments, warn the Communist Parties of Britain, France, Portugal and Spain and the Workers Party of Belgium in a joint statement on Cop30

The US president’s universal tariffs mirror the disastrous Smoot-Hawley Act that triggered retaliatory measures, collapsed international trade, fuelled political extremism — and led to world war, warns Dr DYLAN MURPHY