JOHN GREEN, MARIA DUARTE and ANGUS REID review Fukushima: A Nuclear Nightmare, Man on the Run, If I Had Legs I’d Kick You, and Cold Storage

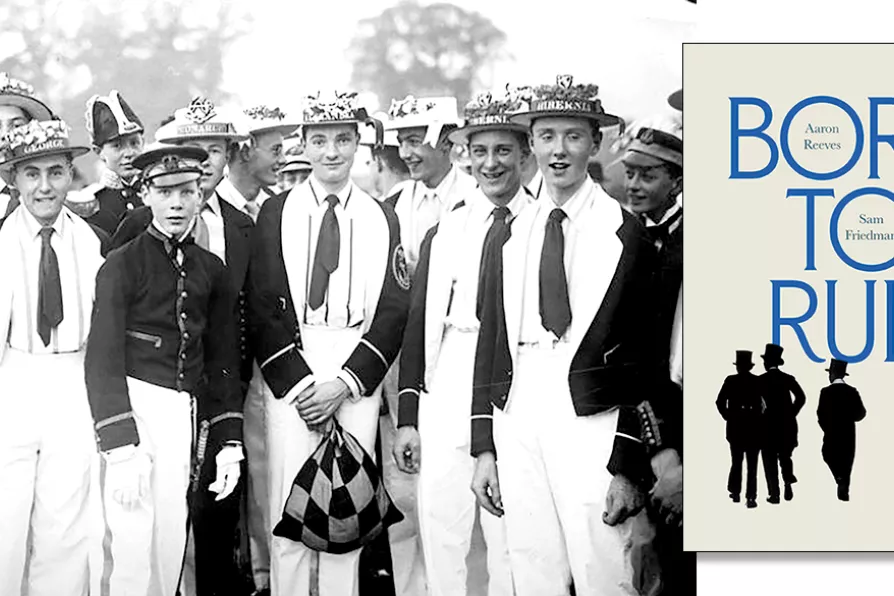

GROOMED TO RULE: Eton College pupils taking part in the ‘Procession of Boats’ on the River Thames during 4th of June celebrations in 1932

[Bundesarchiv/CC]

GROOMED TO RULE: Eton College pupils taking part in the ‘Procession of Boats’ on the River Thames during 4th of June celebrations in 1932

[Bundesarchiv/CC]

Born to rule: the making and remaking of the British elite

Aaron Reeves and Sam Friedman, Harvard UP, £20

THIS study of Britain’s ruling class is based on an analysis of the 125,000 entrants in Who’s Who since 1897. The two authors, professors of sociology at Oxford and the LSE, ask, “Who really rules Britain today? Unsurprisingly, the answer is a very small number – about 6,000 individuals... 0.01 percent of the UK population.” This is the real ruling class.

Within the wider British elite of some 33,000 people sits a wealth elite of around 6,000 people. The wealth elite are in Who’s Who, and they are also in the top 1 per cent of the national wealth distribution. They are 20 times more likely to reach the ruling class than other people.

The authors examine how the propulsive power of family wealth, elite private schools, and Oxbridge ensures that those born into the top 1 per cent are still just as likely to get into that tiny group today as they were 125 years ago: “The main picture our results paint, spanning 125 years of elite recruitment, is one of powerful continuity.”

In 2024, 19 households grew richer by $1 trillion while 66 million households shared 3 per cent of wealth in the US, validating Marx’s prediction that capitalism ‘establishes an accumulation of misery corresponding with accumulation of capital,’ writes ZOLTAN ZIGEDY

While claiming to target fraud, Labour’s snooping Bill strips benefit recipients of privacy rights and presumption of innocence, writes CLAUDIA WEBBE, warning that algorithms with up to 25 per cent error rates could wrongfully investigate and harass millions of vulnerable people

With turnout plummeting and faith in Parliament collapsing, BERT SCHOUWENBURG explains how radical local government reform — including devolved taxation and removal of party politics from town halls — could restore power to communities currently ignored by profit-obsessed MPs