UNIONS called for an end to “rampant profiteering” as official figures showed food inflation remains at a painfully high 9.2 per cent in the run-up to Christmas.

Unite general secretary Sharon Graham said yesterday’s larger-than-expected drop in overall inflation would not offset the real-terms fall in wages this Christmas.

She said: “Headline inflation might be slowing, but workers know their wages aren’t going as far as they did two years ago.

“Even the competition regulator now admits what Unite has said all along: that firms have been exploiting the cost-of-living crisis to raise prices excessively.

“It’s time the government and Bank of England tackled the rampant profiteering in our economy to get inflation under control.”

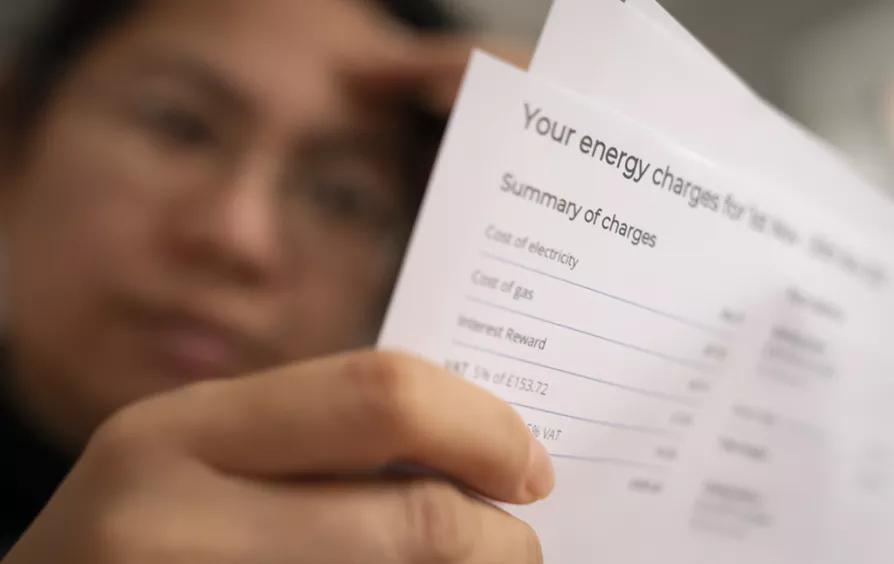

Responding to the figures showing CPI inflation slowing to 3.9 per cent and RPI inflation to 5.3 per cent, TUC general secretary Paul Nowak added: “Today’s inflation figures will provide scant relief for hard-pressed families. Prices are still going up — just a bit more slowly.

“Household budgets remain under immense pressure. And many families will struggle with the cost of Christmas, with food and energy bills sky high.”

Grant Fitzner, chief economist at the Office for National Statistics, which published the figures, warned that while inflation is now at a two-year low, “prices remain substantially above what they were before the invasion of Ukraine.”

Lalitha Try, economist at the Resolution Foundation think tank, explained that transport costs accounted for two fifths of the drop in CPI, with the other main drivers being recreation and culture and food.

“On the other hand, despite a welcome fall on the month, high food inflation — from 10.1 per cent in October to 9.2 per cent last month — added a percentage point to the overall CPI rate,” she added.

“Although inflation’s at its lowest level in over two years, prices have still risen significantly.

“Since September 2021, overall inflation has risen by 17 per cent, energy prices have risen by 66 per cent, and food prices have risen by 29 per cent; but wages have risen by just 14 per cent."

Shadow chancellor Rachel Reeves said: “The fall in inflation will come as a relief to families. However, after 13 years of economic failure under the Conservatives working people are still worse off.”

Experts predicted the Bank of England may reduce its base interest rates of 5.25 per cent in the spring.