CAMPAIGNERS have blasted a lack of regulation in the housing market that leaves people trapped with no choice but to hand over their wages to landlords.

Today’s condemnation came as new figures revealed that the number of first-time buyers had plunged to its lowest level in a decade.

Figures issued by the Yorkshire Building Society showed that the number of first-time buyers in the mortgage market in 2023 stood at 290,000, shrinking by a fifth compared with 2022.

The decrease in first-time buyers followed a string of now-paused interest hikes first made by the Bank of England in December 2021, which pushed up borrowing costs, including mortgages.

The data was unveiled just days after another building society, Nationwide, provided insights into the escalating challenges of housing affordability.

It found that a borrower earning an average income and buying a property with a 20 per cent deposit would have to hand over the equivalent of 38 per cent of their take-home pay to meet their monthly mortgage, way above the long-run average of 30 per cent.

Deposits have remained high at a typical 20 per cent — which equates to over 105 per cent of average annual gross income, the bank found.

The prospect of owning a home has been increasingly out of reach, with deposits hard to save up for, as the cost of living, including rent, continues to increase.

According to a survey by Generation Rent, three in five renters were asked to pay a higher rent in the past year, and a third of those were asked to pay more than £100 more per month.

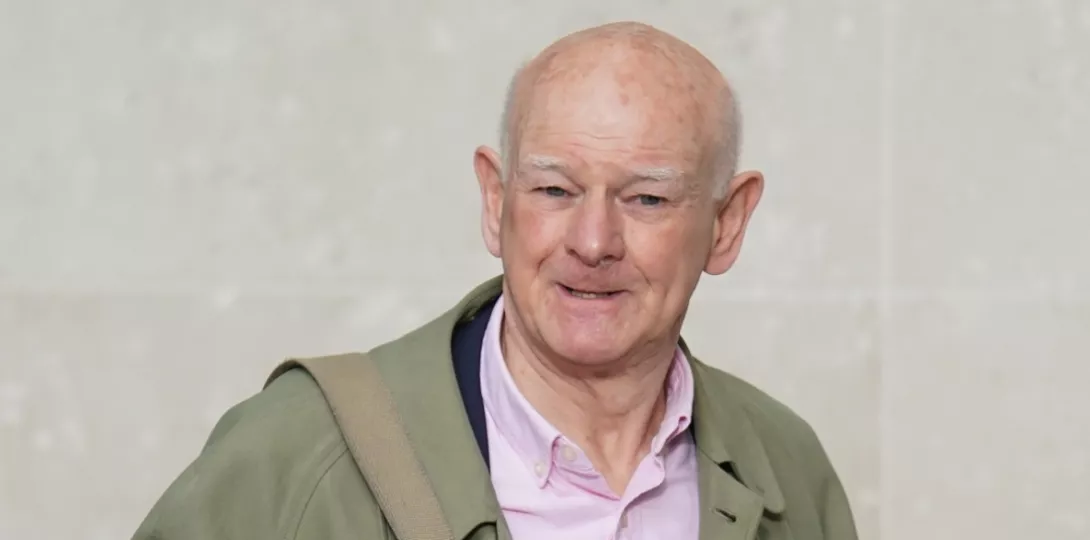

The campaigning group’s chief executive Ben Twomey said: “The cost-of-renting crisis is devastating the hopes of tenants to become first-time buyers.

“It now takes over a decade on average for a renter in England to save for a deposit to buy a home of our own.

“In London, this takes almost 20 years while renting just a single room in a shared house.

“The current system has trapped us with no choice but to give over a third of our wages straight to our landlords.”

Mr Twomey said that it is vital that tenants’ rights are improved with the passage of the long-delayed Renters (Reform) Bill and that more homes are built to help “end the hand-in-hand rocketing of rent costs and homelessness.”