NATWEST’S multimillionaire chief was ridiculed by campaigners today for claiming that it was not “that difficult” to get on the property ladder.

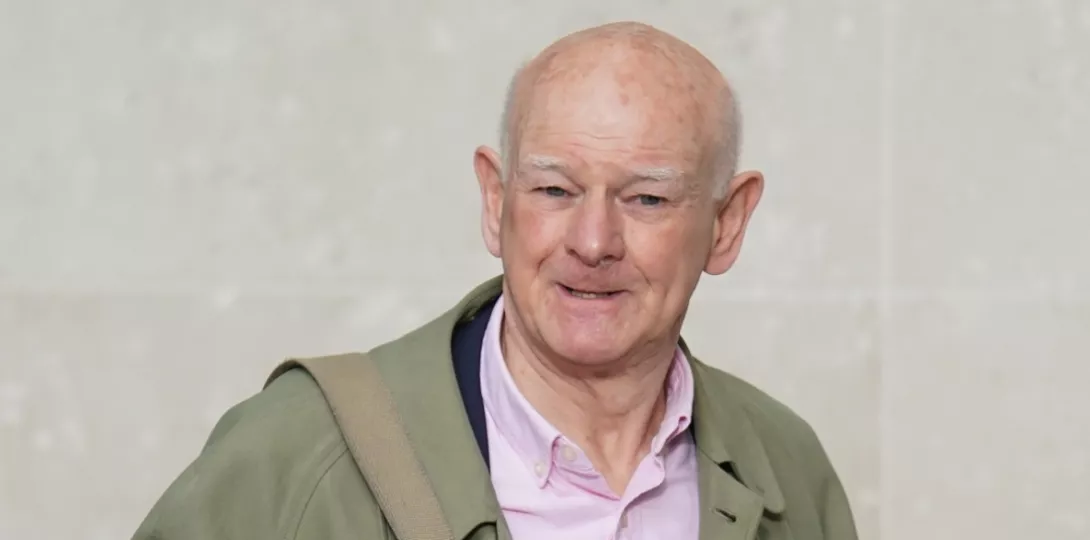

Sir Howard Davies, who takes home over £750,000 a year as the bank’s chairman, lectured that prospective buyers must save and that “is the way it always used to be.”

His remarks followed the Halifax bank announcing that the average home had increased in value by £4,800 in 2023.

The average property now costs £287,105.

Asked on BBC Radio 4’s Today programme when it would be easier for people to get onto the property ladder, Sir Howard said: “I don’t think it is that difficult at the moment.

“I totally recognise that there are people who are finding it very difficult to start the process, they will have to save more, but that is, I think, inherent in the change in the financial system as a result of the mistakes that were made in the last global financial crisis.”

Ben Leonard, policy officer at tenants’ rights group Acorn, condemned the remarks as “out of touch.”

He argued that, with house prices rising and a diminishing number of social homes, the only option for many people is to rent.

“Soaring rental prices and the cost-of-living crisis mean it is hard to just stay above the water, let alone save enough to put down a deposit and to get a mortgage,” Mr Leonard said.

Generation Rent chief executive Ben Twomey asked: “What planet does he live on?”

He added that the comments were “astounding to hear from a senior banker.”

“Interest rates have increased but house prices have yet to correct, meaning we still need to save for a huge deposit but also would need a high income to afford monthly mortgage repayments,” Mr Twomey said.

“Sir Howard recognises the need to save and blames the response to the 2008 financial crisis for this. But the situation has got far worse since the credit crunch.”

According to Generation Rent, in 2012 it took 6.8 years for the average earner in England to save a deposit.

By 2023, this increased to 9.6 years, with the average price of a first-time home rising by 72 per cent.