Pakistan and the IMF reach a deal for the release of millions in financial bailout

PAKISTAN and the International Monetary Fund (IMF) reached a preliminary agreement for the release of $1.1 billion (£800 million) from a $3bn (£2.3bn) bailout following talks in Islamabad, the IMF said today.

Under the deal, Pakistan will receive the final tranche from the bailout that was approved by the IMF in July to save the nation from defaulting on its debt repayments.

An IMF statement said that it “has reached a staff-level agreement with the Pakistani authorities” and noted that approval by the IMF’s executive board “is considered a formality.”

More from this author

ROGER McKENZIE looks back 60 years to the assassination of Malcolm X, whose message that black people have worth resonated so strongly with him growing up in Walsall in the 1980s

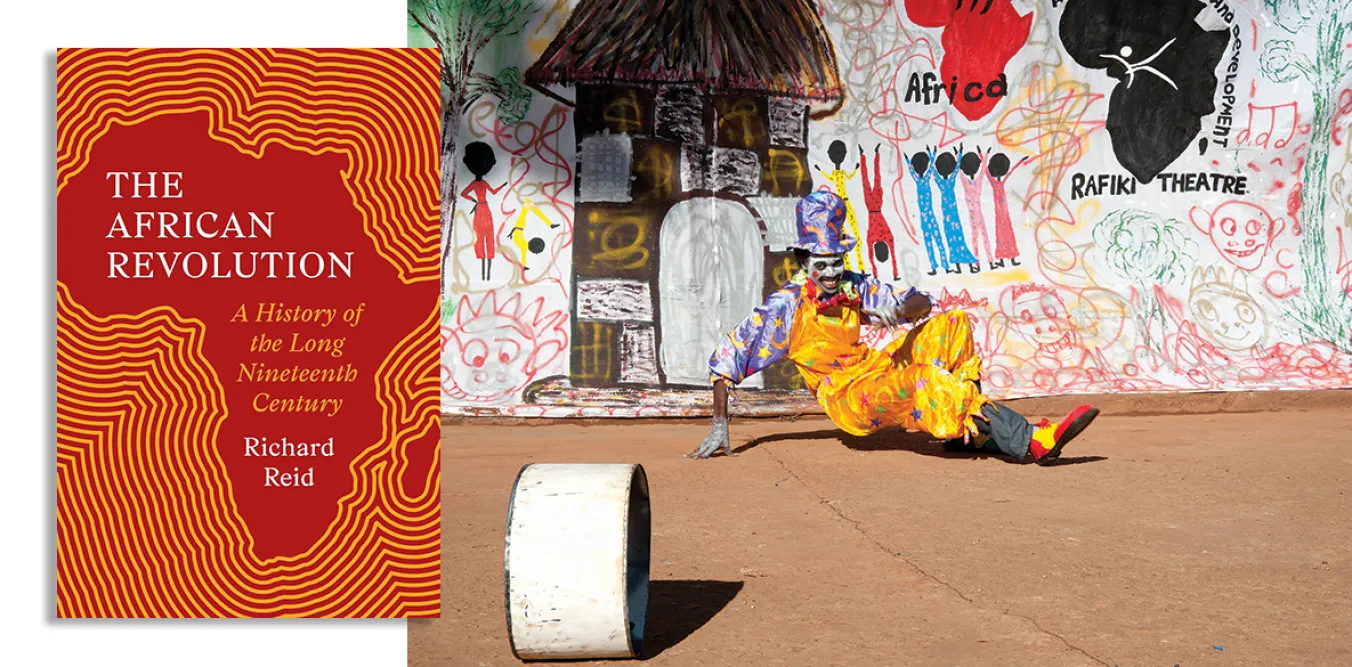

ROGER McKENZIE welcomes an important contribution to the history of Africa, telling the story in its own right rather than in relation to Europeans

Similar stories