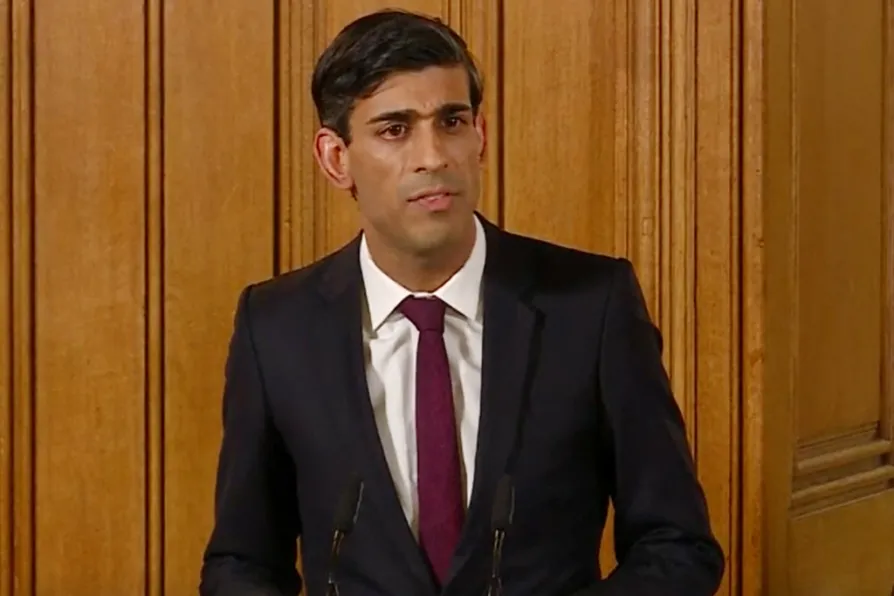

Chancellor of the Exchequer Rishi Sunak

Chancellor of the Exchequer Rishi Sunak

SMALL businesses will be eligible for new fully government-backed “micro” loans worth up to £50,000, it was announced yesterday.

Chancellor Rishi Sunak made the statement in the Commons and MPs asked questions via videolink, as the new “virtual” Parliament adhered to social-distancing rules.

He said firms struggling during the coronavirus pandemic can receive “bounce back” loans worth up to 25 per cent of turnover. The government will pay interest for the first year, he said.

Business owners can apply from next Monday with a “quick standard form” to get the cash 24 hours after approval, and there will be no forward-looking eligibility test, Mr Sunak said.

The £50,000 cap balances the risk to taxpayers with the need to support businesses that “need it most,” he added.

Anneliese Dodds, in her first Commons speech as shadow chancellor, said that it was unsettling that figures suggested that “business confidence has taken a stronger hit in the UK than across the eurozone.”

She added that the government “needs to be open about blocks” it has hit in tackling the spread of the virus and “how it will remove them” to get lockdown restrictions eventually lifted.