FAMILIES face a “raw deal” due to hidden tax rises despite the Tory cut to National Insurance rates, a new Labour campaign warns.

The main rate of National Insurance contributions will be reduced by 2 percentage points to 10 per cent from tomorrow.

Ministers have previously said that cutting the main rate for employees is worth £450 to the average employee on £35,400 in 2024-25.

But Labour argues that income tax and National Insurance thresholds, which have been frozen since 2021, mean that many families have been drawn into higher tax bands.

As the political parties kick off a general election year, Labour launched its new poster campaign today, which features a colourful image of Prime Minister Rishi Sunak in the style of a mock shopping deal advertisement.

Hitting out at “Rishi’s raw deal” for taxpayers, it was unveiled on a shopfront and ad van in Wellingborough and was also published online and in regional newspapers across the country.

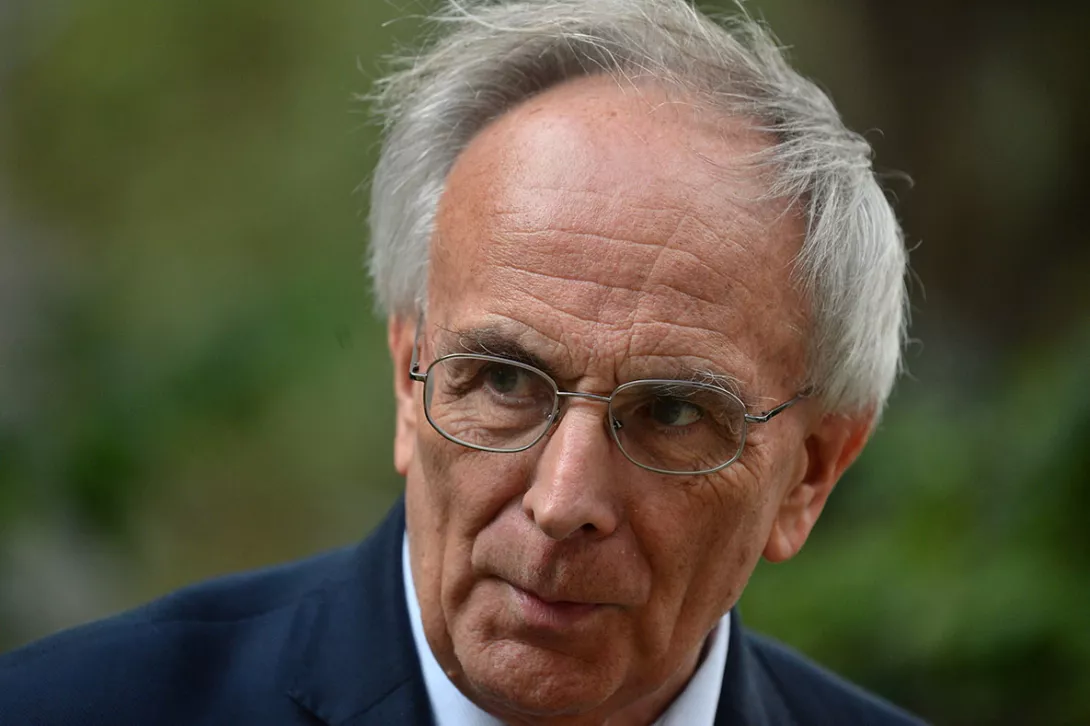

Wellingborough faces a by-election after local Conservative MP Peter Bone was ousted from the party and suspended from the Commons for breaching the MPs’ code of conduct.

Shadow chancellor Rachel Reeves said: “Under Rishi Sunak’s raw deal, for every extra £10 people are paying in tax, they are only getting £2 back.

“Working people know that this month’s tax con is just a cynical giveaway from a weak and out-of-touch Tory government that is desperate to cling onto power, rather than a credible plan to fix our broken economy.

“After 14 years of working people being left worse off under the Conservatives, it’s time for change.

“Rishi Sunak should call an election and give the public the chance to vote for a changed Labour Party that will change Britain for the better.”