THE Tories have fuelled speculation they are going to hand out a tax giveaway to multimillionaires after announcing March 6 as the date of the spring budget.

Sources close to the Prime Minister Rishi Sunak said he has demanded a “gear shift” on tax, with No10 considering axing inheritance tax altogether in the coming months, according to reports by the Telegraph.

Labour’s shadow financial secretary James Murray accused Mr Sunak of “trying to buy off his backbenchers with an unfunded tax cut for millionaires” while families across Britain struggle with the cost of living.

Mr Murray called the move “a desperate briefing from a desperate Prime Minister who is spending his Christmas break trying to keep Tory MPs on side.”

When asked today if the PM believes inheritance tax is fair, a No 10 spokeswoman said she would not enter into speculation but admitted: “The tax is forecast to contribute £10 billion a year by 2028-29 to help fund public services that millions of us rely on.”

Downing Street is reportedly also considering cutting the basic 20 per cent income tax rate, and raising the 40 per cent threshold, as the Tories scramble to win over voters ahead of next year’s general election.

While Labour is about 20 points ahead in the polls, in a bid to gain support, Housing Secretary Michael Gove suggested to the Times that the Tories will promise to cut the up-front cost of a home for first-time buyers.

When asked by the newspaper whether the Conservatives would be able to go into next year’s expected election promising more help for first-time buyers, Mr Gove said: “Oh, yes, we must. Definitely.”

The attention-grabbing pledges surfaced as Chancellor Jeremy Hunt announced that a spring budget will be set out on March 6, in what could be the Tory government’s last chance to introduce major spending changes before the general election, which is expected to be held in autumn.

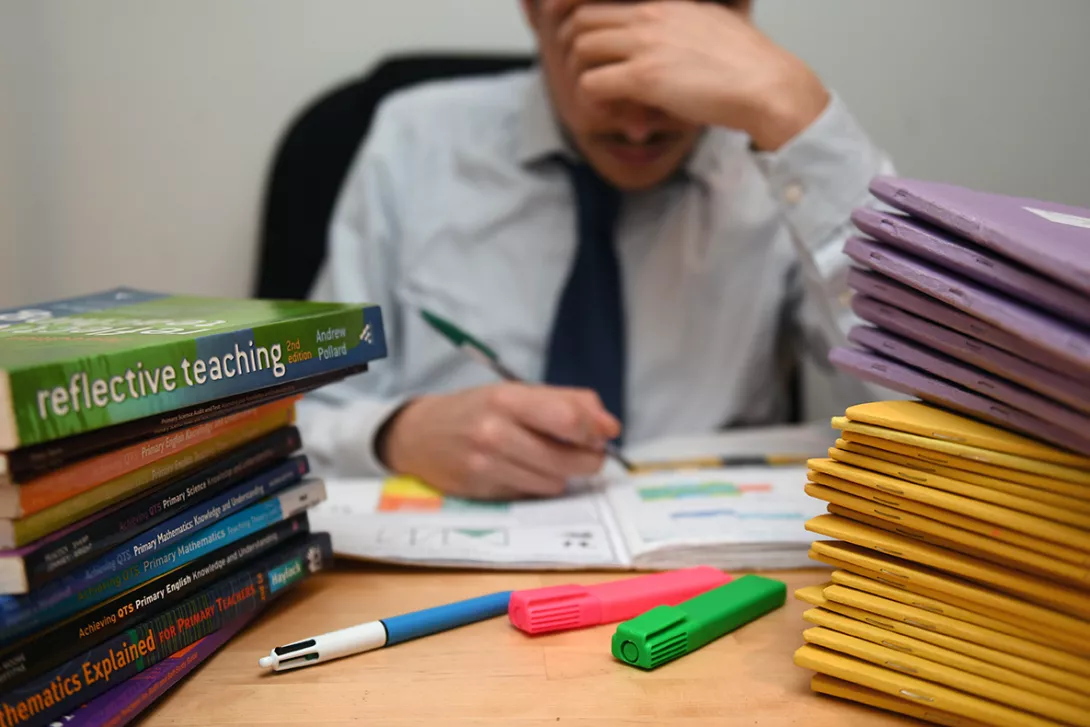

Mr Hunt’s previous budget was condemned by the TUC as “a plan for levelling the country down.”

In his autumn statement, the Chancellor took aim at benefit claimants with draconian measures designed to force them off welfare while ordering “the biggest business tax cut in modern British history” and extending tax relief on firms in special freeports or investment zones.